unemployment tax forgiveness pa

File and Pay Quarterly. First figure out your eligibility income by completing a PA-40.

Tax Changes What S New For Filing Taxes At The Irs In 2022 Money

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

. Get Information About Starting a Business in PA. Employer Tax Services. In Part D calculate the amount of your Tax Forgiveness.

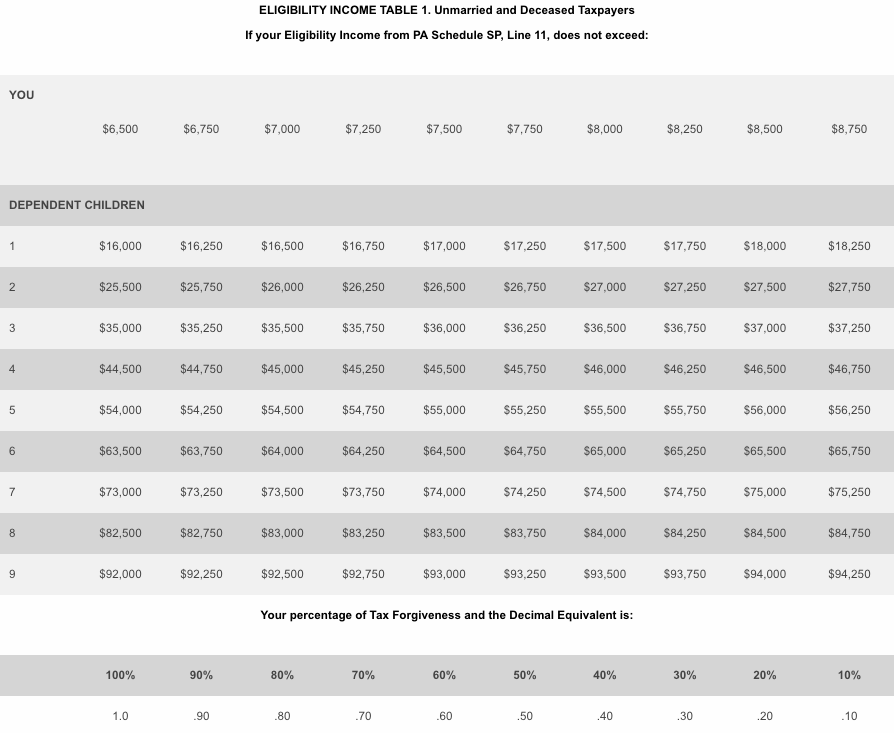

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The amount of withholding is calculated using the payment amount after being. Register to Do Business in PA.

Register for a UC Tax Account Number. Submit Amend View and Print Quarterly Tax Reports. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020.

Report the Acquisition of a Business. For example a family of four couple with two dependent. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

Ad 4 Simple Steps to Settle Your Debt. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. UCMS provides employers with an online platform to view andor perform the following.

Ad Fill out form to find out your options for FREE. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Record tax paid to other states or countries.

Ad Apply For Tax Forgiveness and get help through the process. Provides a reduction in tax. Taxpayers who receive unemployment compensation are encouraged to watch their mailboxes during the tax season for the 1099G tax form that is required to file your federal.

To claim this credit it is necessary that a taxpayer. Record the your PA tax liability from Line 12 of your PA-40. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings. In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason. UC Unemployment Benefits UC Handbook Overpayments and.

Checks or money orders for all federal and state overpayments should be made payable to the PA UC Fund and mailed to. The purpose is to. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

The Unemployment Compensation UC program provides temporary income support if you lose your job or are working less than your full-time hours. Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify. Office of UC Benefits.

Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment. If your modified adjusted gross income AGI is less than 150000 the. Eligibility income for Tax Forgiveness is different from taxable income.

You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent.

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

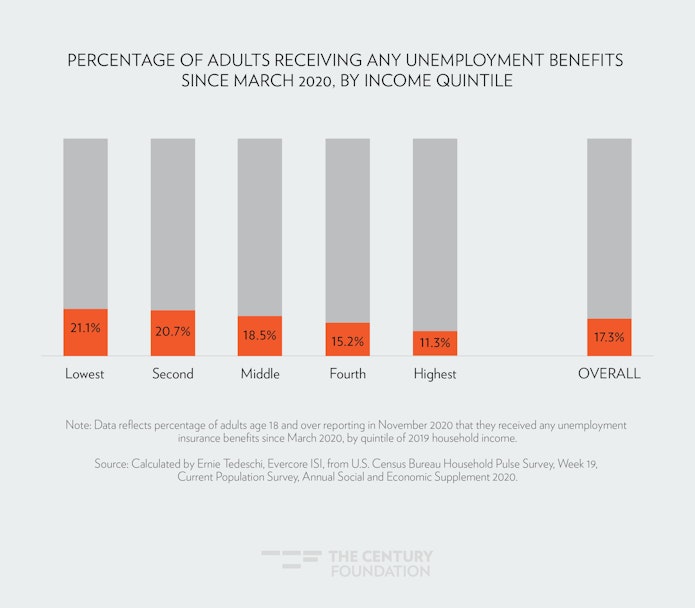

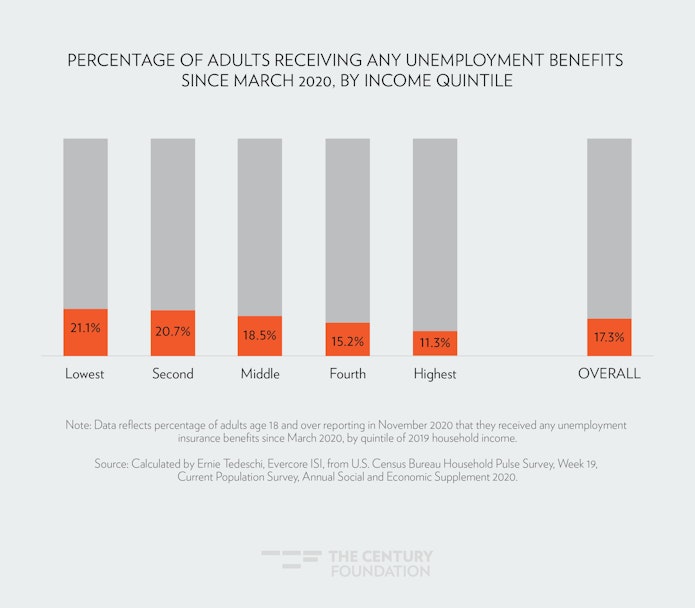

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Cares Act Jjthecpahelp Com Acting The Borrowers Care

When Are Taxes Due In 2022 Forbes Advisor

The Case For Forgiving Taxes On Pandemic Unemployment Aid

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Deal Imminent Fourth Stimulus Check Update Unemployment Update The The Daily Show Daily News Child Tax Credit

Tax Stimulus Checks See The 14 States That Are Sending Out Tax Rebate Payments Marca

2022 Federal Payroll Tax Rates Abacus Payroll

Wfh And Your Taxes Wfh The New Normal What The Heck

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

![]()

What To Know About Unemployment Refund Irs Payment Schedule More