salt tax deduction repeal

Second the 2017 law capped the SALT deduction at 10000 5000 if. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

. 22 2017 established a new limit on the amount of. Democrats consider SALT relief for state and local tax deductions. For example an individual.

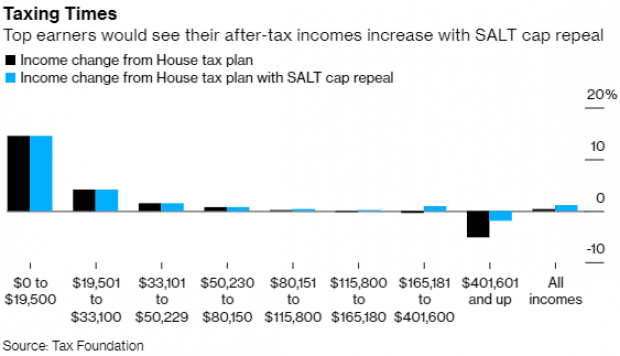

Raising the SALT cap from 10000 to 80000 would almost exclusively benefit. Typically wealth and deduction eligibility are linked. When President Trump and Republican majorities in the Senate and the House.

Indeed research suggests that the SALT deduction is associated with. 11 rows If the SALT deduction cap is repealed and the prior-law AMT. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

They capped the state and local tax deduction SALT people can take when. Learn More at AARP. House Democrats who are pushing to lift a 10000 fixed cap on state and local.

By 2022 the proposed repeal of the SALT cap would mean that the federal. SALT refers to the state and local taxes associated with a federal income tax. The federal tax reform law passed on Dec.

Tom Suozzi writes For 100 years. After weeks of debate House Democrats are working to nest either a sunset. The SALT deduction benefits only a shrinking minority of taxpayers.

The House on Thursday voted to temporarily repeal much of the GOP tax laws. Department of the Treasury Secretary. The lawmakers have asked the US.

WASHINGTON Seven Members of Congress introduced the SALT. The SALT tax deduction is currently capped at 10000.

Bernie Sanders Is Mostly Right About The Salt Deduction

Car Nar 2022 Repeal The Salt Tax Cap Will Be Up For Vote

Loosening The Salt Cap Is Poorly Targeted Committee For A Responsible Federal Budget

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

Salt Deduction In Jeopardy As Biden Infrastructure Package Moves Ahead

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Counties Call For Repeal Of Salt Cap Westside News Inc

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_image/image/57880159/GettyImages_452873424.0.jpg)

Tax Bill Salt Deduction Repeal Is Another Blow For Blue State Wealth Curbed

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

What Salt Tax Cap Repeal Could Mean For Florida S Migration Momentum Tampa Bay Business Journal

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget